-

About Union

about union

Geographical & Economic

Miscellaneous

-

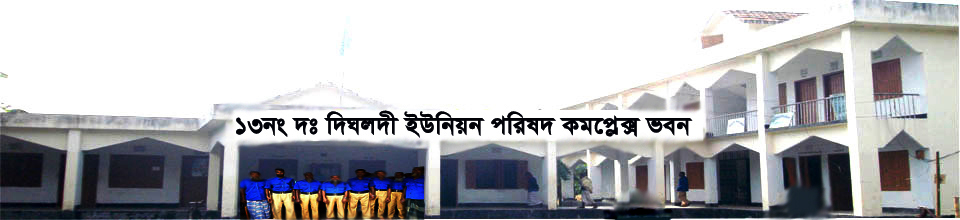

Union Parishad

Union Council

Activities of Union Council

-

Govt. Office

Agriculture

Land

Health Services

Social Service

-

Other Institutions

Educational Institutions

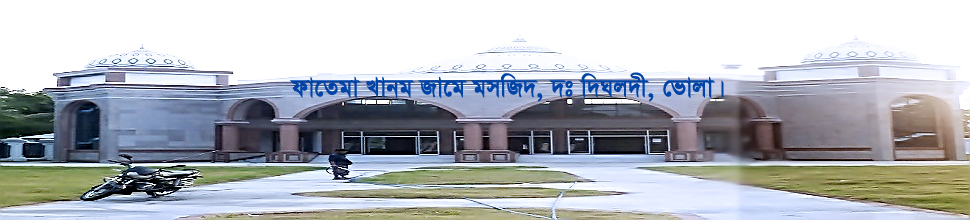

Religious Organizations

Organizations

-

Different Lists

List of Beneficiarie s

Other listings

- Projects

-

Services

UDC

National E-Service

-

Gallery

-------

-

About Union

about union

Geographical & Economic

Miscellaneous

-

Union Parishad

Union Council

Activities of Union Council

-

Govt. Office

Agriculture

Land

Health Services

Social Service

-

Other Institutions

Educational Institutions

Religious Organizations

Organizations

-

Different Lists

List of Beneficiarie s

Other listings

- Projects

-

Services

UDC

National E-Service

-

Gallery

-------

Citizen Charter

* Land development tax information: Annual land development tax rate from 1394 to 1397 Bengal.

A. Agriculture: 0.03 per cent from 0.01 acre to 2.00 per cent. From 01.01 acres to 5.00 acre, the rate is 0.30 per cent. 5.01 acre to 8.25 acre per cent at the rate of 0.50. Up to 8.25 acres, ie up to 20.00 acre, every cent is at Tk 2 / -.

B. Resident rate is 5% per cent.

C. Commercial: Per Cent of 17 / - per cent.

* Annual land development tax rate from 1394 to 1397 Bengal.

A. Agriculture: Waste development from 0.01 acre to 825 acres of land. From 8.25 acres to 10.00 acre, every cent is 0.50 paise. 10.01 per acre, ie, up to 20.00 acre per cent per 1 / - taka.

B. Resident rate is 5% per cent.

C. Commercial: Per Cent of 15%

Note that for the development tax, the annual rate of interest of 6.25% will be paid.

* Migrations, submissions, submissions, heirs, mock laws, litigation rules:

01. To file any such case mentioned above, the application has to be submitted to the Assistant Commissioner (Land).

0. The applicant will have to pay a fine of Rs. 7 / - as per the application form.

03. The documents required for the certificate, such as the certificate of the original document, the documents, the warrant certificate for the succession, the copy of the concerned Khatian, the status of the updating of the land and the passport size of the applicant.

Cost of mutation:

01. Application fee of Rs. 7 / -

0. Notices for issuing fee 2 / - for every four people. If there is more than four, then the rate of 50.00 for every person

03. Record Compensation Fee Rs.200 / -

04. Mutation of copy of each copy will be 25 + 18 = 43 / -.

Total = 252 / - pa

05. How many days the mutation process will be done: if there is no dispute about ownership, the application will be completed within 45 working days from the date of receipt.

Planning and Implementation: Cabinet Division, A2I, BCC, DoICT and BASIS