-

About Union

about union

Geographical & Economic

Miscellaneous

-

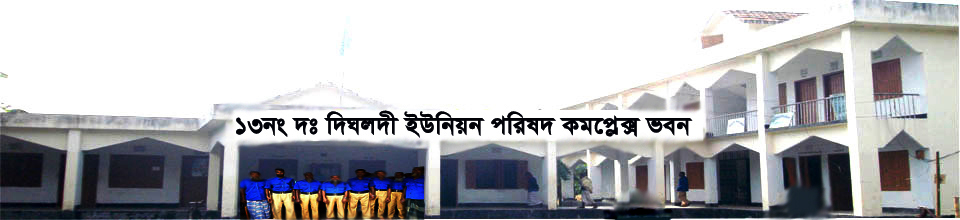

Union Parishad

Union Council

Activities of Union Council

-

Govt. Office

Agriculture

Land

Health Services

Social Service

-

Other Institutions

Educational Institutions

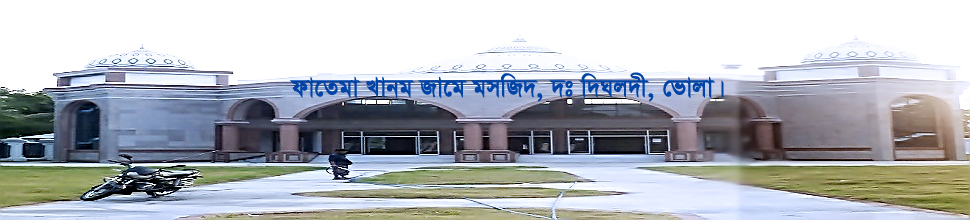

Religious Organizations

Organizations

-

Different Lists

List of Beneficiarie s

Other listings

- Projects

-

Services

UDC

National E-Service

-

Gallery

-------

-

About Union

about union

Geographical & Economic

Miscellaneous

-

Union Parishad

Union Council

Activities of Union Council

-

Govt. Office

Agriculture

Land

Health Services

Social Service

-

Other Institutions

Educational Institutions

Religious Organizations

Organizations

-

Different Lists

List of Beneficiarie s

Other listings

- Projects

-

Services

UDC

National E-Service

-

Gallery

-------

List of services

1. Recovery of land development tax. Preservation of Government Khas lands.3. Landless agricultural land settlement .4. Namazir proposed .5. Store the updated land records in the Office.6. Applicable to the market from the market of Hat .7. Protecting the government waterways .8. S, the record is updated. 9. Land tax is collected. 10. Government lands are visited. 11. Summary of information on land and semi-land. The information given is to be given. 13.17. Send a reply to the Dewani Mokaddam. The application for the posting should be submitted along with the Assistant Commissioner (Land). The following documents should be submitted with the application of the change. (A) Applicable cases: 1. Copy of purchase documents and necessary documents. 2. Warrant certificate 3 The copy of the Heavy Documents and all the records or the Verdict copy of the Verdict FIDE copy. 4. After the latest survey, the Survey / Photocopy of Air Pitt Document Land Development Tax Payment 6. Cost of mutation: (a) Court fee of application fee = 5 / - (five taka) (b) Notice of issuance of notice = 2 / - (two taka) (for 4 people) for four people For every penny more will be recovered as 0.50 rupees (c) Record Correction fee = 200 / - (two hundred) rupees (d) Mutation mutation fee fee = 43 / - (Tenthalis) T. Moneymart = 250 / ( Two hundred fifty taka + more than four people, notice fee more for each 0.50 Assistant Commissioner (Land) / Upazila Nirbahi Officer / Revenue Deputy Collector / Additional Deputy Commissioner (Revenue) or District, if the claim is not disposed of within 45 days from the date of submission of application, and no additional fee for the mentioned cost will be made. Contact the administrator.

Planning and Implementation: Cabinet Division, A2I, BCC, DoICT and BASIS